REAL ESTATE INVESTORS, HOUSE FLIPPERS

We help you manage your most precious asset: TIMEHere at Panacea Lending, LLC we are proud to present our proprietary technology solution that will help investors like you create and grow the pipeline you desire. Our software will help you create a system that allows you to flip houses for a living!

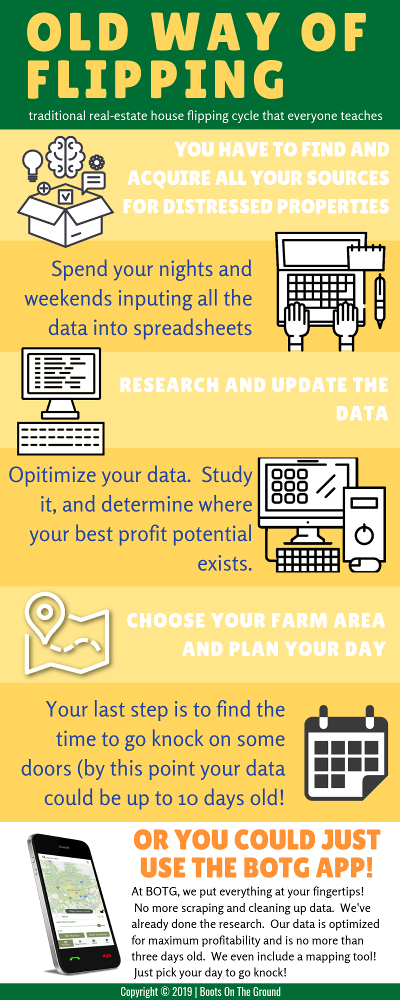

Finding the right investment house can be daunting. We help you by finding the right distressed properties, that you can make a profit on. Whether because of disrepair, divorce, or other financial difficulties, let us help you meet those motivated sellers.

So whether you are a beginner or an experienced home investor, Boots On The Ground is ready to help you succeed!

At Panacea Lending, LLC, we specialize in

LEADS, FUNDING & EFFICIENCY

DOWNLOAD THE BOTG APP

Get Access to Exclusive Intel on Property Leads

No more searching for the data and then having to clean it up for analyzing. We have done all of that time consuming work for you. We are your eyes and ears helping you find the right information in the quickest most accurate way possible.

Sign Your Lead Today

With data no more than 6 days old, our app gives you the confidence and ability to make an offer or refer a loan immediately.

Lock Properties to You

You can be assured of the most accurate data available when you are the first and only person that talks to your lead.

Be a Part of Our Team

Our software only shows you the real estate that produce income! Let the app guide you to only the properties you choose, in the most efficient manner possible. When you join BOTG, we are your back-office support team helping you with the locating of properties all the way to the closing and funding of the sale.